(Hedge with NSE WTI Crude Contracts - Hedging at NSE offers key advantages like INR-denominated contracts, cash settlement, transparent pricing, and low transaction costs)

WTI Crude Oil

Crude Oil Derivatives (Brent and WTI) are the highest traded product in the Commodities market space.

Crude Oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. A type of fossil fuel, crude oil can be refined to produce usable products such as gasoline, diesel and various forms of petrochemicals. It is a non-renewable resource, which means that it can't be replaced naturally at the rate we consume it and is, therefore, a limited resource.

WTI Crude oil is a specific grade of crude oil and one of the main three benchmarks in oil pricing, along with Brent and Dubai Crude. WTI is known as a light sweet oil because it contains between 0.24% and 0.34% sulfur, making it "sweet," and has a low density (specific gravity), making it "light."

WTI is the underlying commodity of the New York Mercantile Exchange's (NYMEX) oil futures contract and is considered a high-quality oil that is easily refined.

Factors affecting Market fundamentals

- OPEC & Non-OPEC Decisions & Broadcasts

- US Crude Inventories

- Economic factors: Recession, Inflation & Crisis

- Speculation, Hedging & Investment

- Geopolitical actions

- Weather

- Global Economic Growth & Trade Policies

Crude Oil is used in the following industries

- Oil Marketing/Refining Companies

- Glass Manufacturers

- Transport / Aviation

- Lubricants

- Petro-Chemical industry

- FMCG

- Industrial Power

- Paint Manufacturers

- Plastics Industry

- Rubber / Tyre Manufacturers

(Crude oil price movements affect multiple industries like lubricants, power, glass, transport, petrochemicals, and FMCG)

NSE WTI Crude Oil Specifications - Futures and Options on Futures

| WTI CRUDE OIL | Regular | |

|---|---|---|

| LOT SIZE | 100 Barrel | |

| SYMBOL | WTICRUDE | |

| QUOTATION |

₹ Per 1 Barrel |

|

| CONTRACT CYCLE | Monthly contracts | |

| TRADING SESSION |

Monday - Friday 9:00 am to 11:30 / 11:55 pm* * Based on US daylight saving time period |

|

| SETTLEMENT |

Futures: Cash Settled Options: On NSE WTI Crude Oil Futures |

|

| DUE DATE RATE(DDR) / FINAL SETTLEMENT PRICE (FSP) |

Futures: Due date rate (FSP) shall be the settlement price, in Indian rupees, of the New York Mercantile Exchange’s (NYMEX)# Crude Oil (CL) front month contract on the last trading day of the NSE WTI Crude Oil contract. The last available RBI USDINR reference rate will be used for the conversion. The price so arrived will be rounded off to the nearest tick. Options: Daily settlement price of underlying futures contract on the expiry day of options contract. |

|

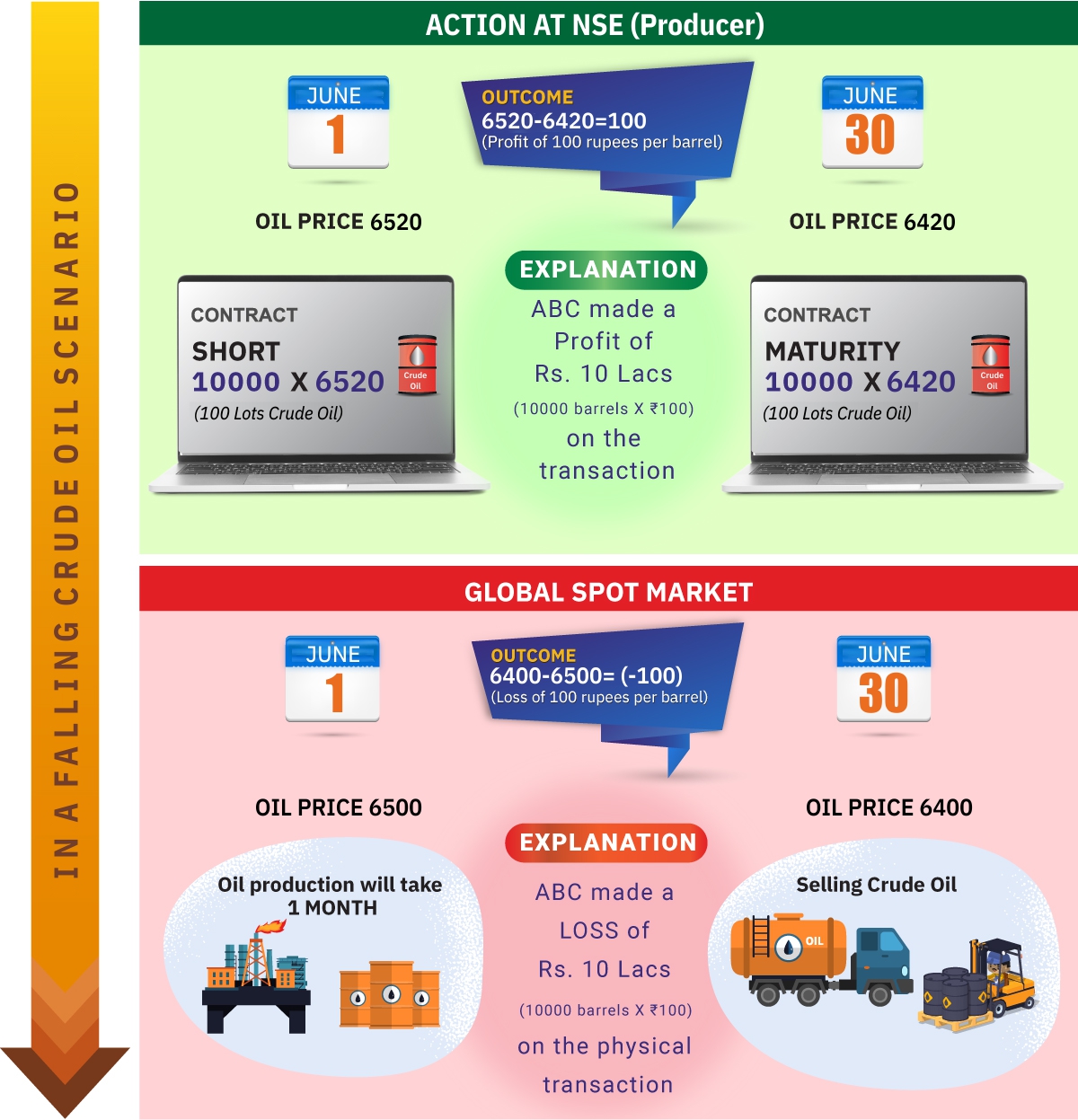

(In a falling crude oil price environment, a producer named ABC uses NSE futures to hedge.

ACTION AT NSE (Producer) – Hedged Position

- June 1: ABC, the producer, expects crude oil prices to fall. So, they short 100 lots (10,000 barrels) of crude oil futures at ₹6520/barrel on NSE.

- June 30: The price drops to ₹6420/barrel.

- Outcome: The short position gains ₹100/barrel, resulting in a profit of ₹10 lakhs (10,000 barrels × ₹100).

GLOBAL SPOT MARKET – Physical Sale

- June 1: ABC begins oil production when the spot price is ₹6500/barrel.

- June 30: By the time the oil is ready to sell, the price has dropped to ₹6400/barrel.

- Outcome: ABC incurs a loss of ₹100/barrel, totalling ₹10 lakhs (10,000 barrels × ₹100).

The ₹10 lakh profit from the futures contract offsets the ₹10 lakh loss in the physical market. This demonstrates how hedging with NSE futures can protect producers from adverse price movements in volatile markets.)

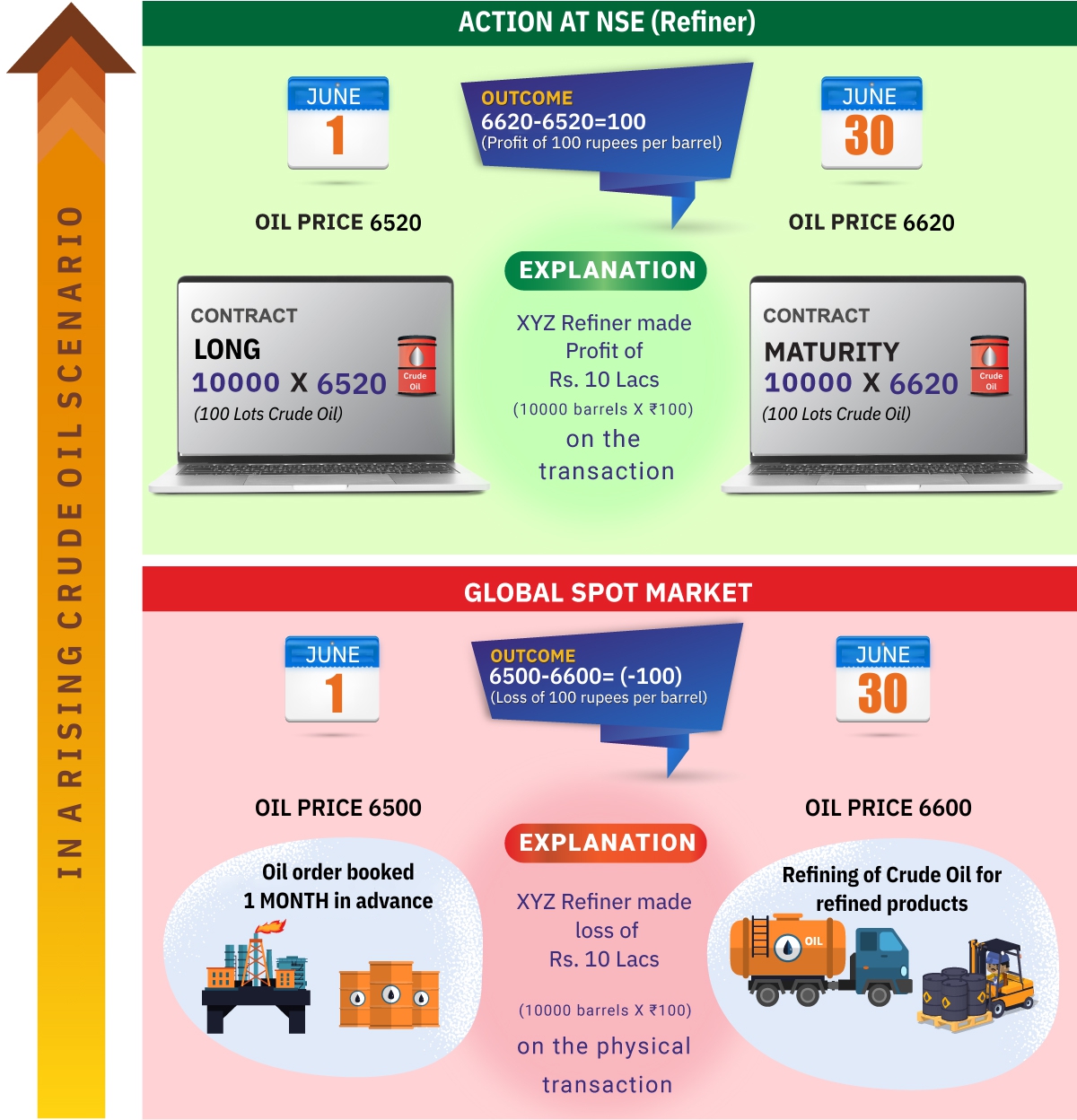

(In a rising crude oil price environment, a refiner named XYZ uses NSE futures to hedge.

ACTION AT NSE (Refiner) – Hedged Position

- June 1: XYZ, the refiner, anticipates a rise in crude oil prices. So, they go long on 100 lots (10,000 barrels) of crude oil futures at ₹6520/barrel on NSE.

- June 30: The price increases to ₹6620/barrel.

- Outcome: The long position gains ₹100/barrel, resulting in a profit of ₹10 lakhs (10,000 barrels × ₹100).

GLOBAL SPOT MARKET – Physical Purchase

- June 1: XYZ books crude oil one month in advance where spot price was ₹6500/barrel

- June 30: The price rises to ₹6600/barrel, and XYZ must now purchase at the higher rate.

- Outcome: XYZ incurs a loss of ₹100/barrel, totaling ₹10 lakhs (10,000 barrels × ₹100).

The ₹10 lakh profit from the futures contract offsets the ₹10 lakh loss in the physical market. This demonstrates how hedging with NSE futures helps refiners manage rising input costs and maintain financial stability)

Disclaimer

CME GROUP MARKET DATA IS USED UNDER LICENSE AS A SOURCE OF INFORMATION FOR CERTAIN NSE PRODUCTS. CME GROUP HAS NO OTHER CONNECTION TO NSE PRODUCTS AND SERVICES AND DOES NOT SPONSOR, ENDORSE, RECOMMEND OR PROMOTE ANY NSE PRODUCTS OR SERVICES. CME GROUP HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE NSE PRODUCTS AND SERVICES. CME GROUP DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF ANY MARKET DATA LICENSED TO NSE AND SHALL NOT HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN CME GROUP AND NSE.

(Hedge with NSE WTI Crude Contracts - Hedging at NSE offers key advantages like INR-denominated contracts, cash settlement, transparent pricing, and low transaction costs)