(Hedge with NSE Natural Gas Contracts - Hedging at NSE offers key advantages like INR-denominated contracts, cash settlement, transparent pricing, and low transaction costs )

Natural Gas

Natural gas is found in deep underground rock formations or associated with other hydrocarbon reservoirs in coal beds and as methane clathrates. Natural gas is simply referred to as gas, especially when compared to other energy sources like electricity.

Natural gas is used mainly in the industrial, commercial, transportation, and household sectors. The power and fertilizer sectors are the largest consumers of natural gas.

Domestic consumption growth has been satisfied through liquified natural gas (LNG) imports whose share in the country’s natural gas consumption is approx. 50 per cent. Thus, the Natural Gas in India has strong linkages to the Global Natural Gas prices.

Price affecting factors

- Natural Gas inventory data

- Weather conditions

- Crude oil price trend

- Demand scenario

(The natural gas supply chain covers stages from exploration and liquefaction to shipping, regasification, transmission, storage, and distribution. NSE’s Natural Gas Futures and Options is a beneficial tool for risk management across this value chain)

NSE Natural Gas Specifications - Futures and Options on Futures

| NATURAL GAS | Regular | |

|---|---|---|

| LOT SIZE | 1250 mmBtu | |

| SYMBOL | NATURALGAS | |

| QUOTATION | ₹ per mmBtu | |

| CONTRACT CYCLE | Monthly contracts | |

| TRADING SESSION |

Monday - Friday 9:00 am to 11:30 / 11:55 pm* * Based on US daylight saving time period |

|

| SETTLEMENT |

Futures: Cash Settled Options: On NSE Natural Gas Futures |

|

| DUE DATE RATE(DDR) / FINAL SETTLEMENT PRICE (FSP) |

Futures: Due date rate (FSP) shall be the settlement price, in Indian rupees, of the New York Mercantile Exchange’s (NYMEX)# Natural Gas (NG) front month contract on the last trading day of the NSE Natural Gas contract. The last available RBI USDINR reference rate will be used for the conversion. The price so arrived will be rounded off to the nearest tick. Options: Daily settlement price of underlying futures contract on the expiry day of options contract. |

|

(In a falling natural gas price environment, a producer named ABC uses NSE futures to hedge.

ACTION AT NSE (Producer) – Hedged Position

- June 1: ABC, the producer, expects natural gas prices to fall. So, they short 100 lots (125,000 mmBtu) of natural gas futures at ₹185/mmBtu on NSE.

- June 30: The price drops to ₹175/mmBtu.

- Outcome: The short position gains ₹10/mmBtu, resulting in a profit of ₹12.5 lakhs (125,000 mmBtu × ₹10).

GLOBAL SPOT MARKET – Physical Sale

- June 1: ABC begins gas production when the spot price is ₹185/mmBtu.

- June 30: The price drops to ₹175/mmBtu, and ABC sells the gas at this lower rate.

- Outcome: ABC incurs a loss of ₹10/mmBtu, totaling ₹12.5 lakhs (125,000 mmBtu × ₹10).

The ₹12.5 lakh profit from the futures contract offsets the ₹12.5 lakh loss in the physical market. This demonstrates how hedging with NSE natural gas futures can protect producers from price declines in volatile markets)

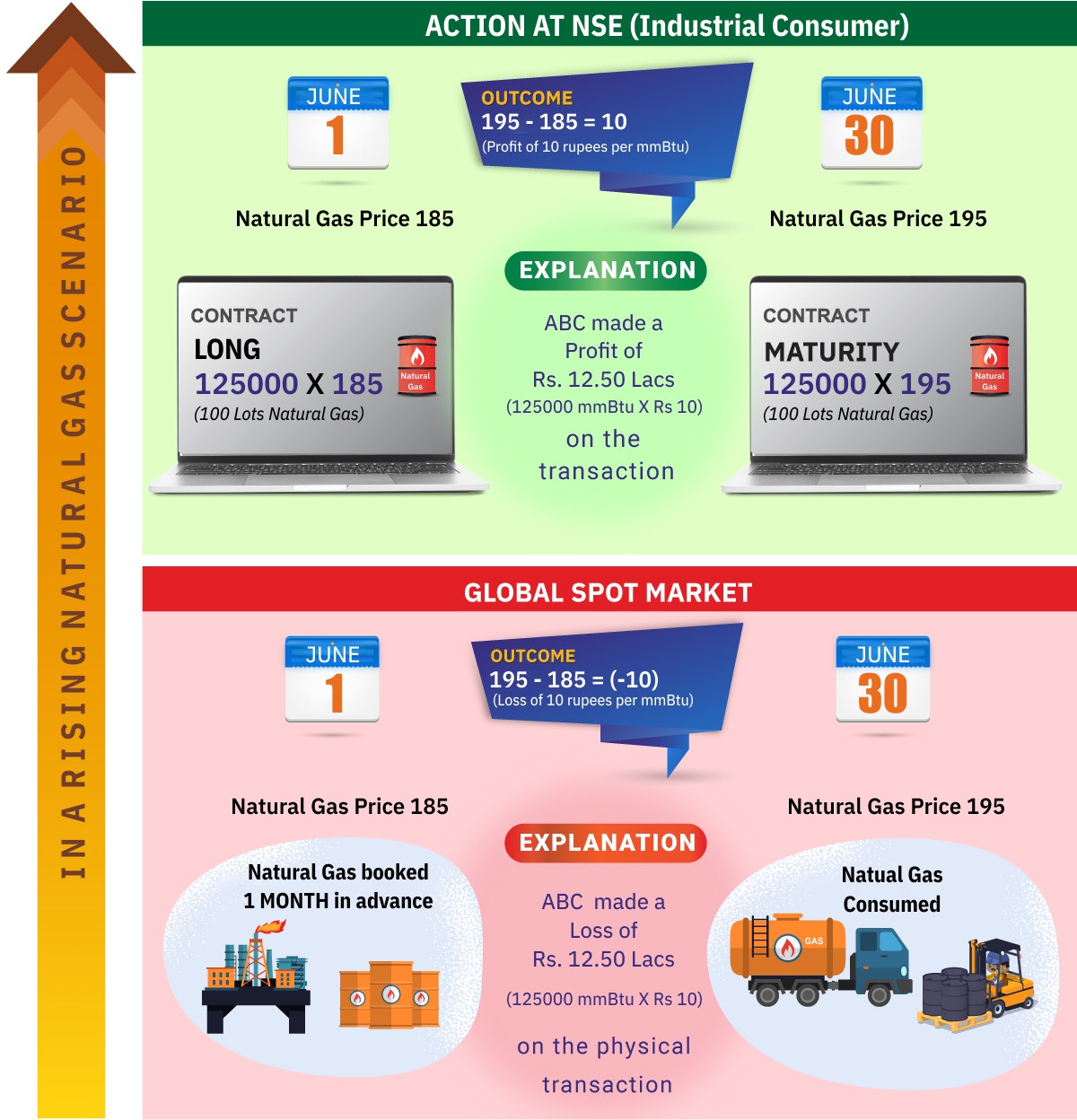

(In a rising natural gas price environment, an industrial consumer named ABC uses NSE futures to hedge.

ACTION AT NSE (Industrial Consumer) – Hedged Position

- June 1: ABC, expecting natural gas prices to rise, goes long on 100 lots (125,000 mmBtu) of natural gas futures at ₹185/mmBtu on NSE.

- June 30: The price increases to ₹195/mmBtu.

- Outcome: The long position gains ₹10/mmBtu, resulting in a profit of ₹12.5 lakhs (125,000 mmBtu × ₹10)

GLOBAL SPOT MARKET – Physical Purchase

- June 1: ABC books natural gas at a spot price of ₹185/mmBtu.

- June 30: The price rises to ₹195/mmBtu, and ABC must now purchase at the higher rate.

- Outcome: ABC incurs a loss of ₹10/mmBtu, totaling ₹12.5 lakhs (125,000 mmBtu × ₹10).

The ₹12.5 lakh profit from the futures contract offsets the ₹12.5 lakh loss in the physical market. This demonstrates how hedging with NSE natural gas futures helps industrial consumers manage rising input costs and maintain cost stability)

Disclaimer

CME GROUP MARKET DATA IS USED UNDER LICENSE AS A SOURCE OF INFORMATION FOR CERTAIN NSE PRODUCTS. CME GROUP HAS NO OTHER CONNECTION TO NSE PRODUCTS AND SERVICES AND DOES NOT SPONSOR, ENDORSE, RECOMMEND OR PROMOTE ANY NSE PRODUCTS OR SERVICES. CME GROUP HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE NSE PRODUCTS AND SERVICES. CME GROUP DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF ANY MARKET DATA LICENSED TO NSE AND SHALL NOT HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN CME GROUP AND NSE.